How Curve Pay works

in 4 easy steps.

Curve Pay puts all your cards in one smart wallet — helping you save, switch, and earn with every payment.

Curve Pay puts all your cards in one smart wallet — helping you save, switch, and earn with every payment.

Download and install . It's completely free and takes two minutes to sign up.

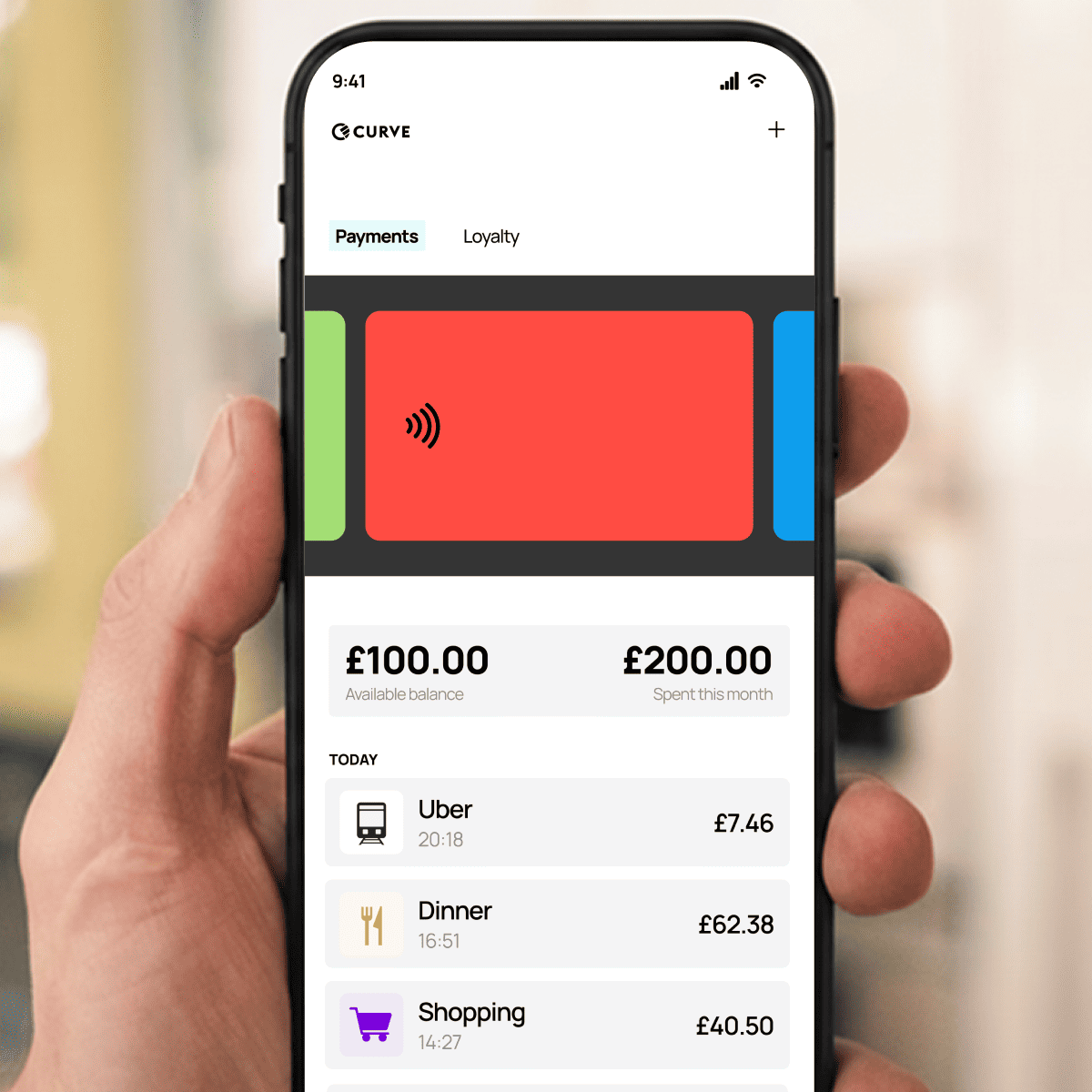

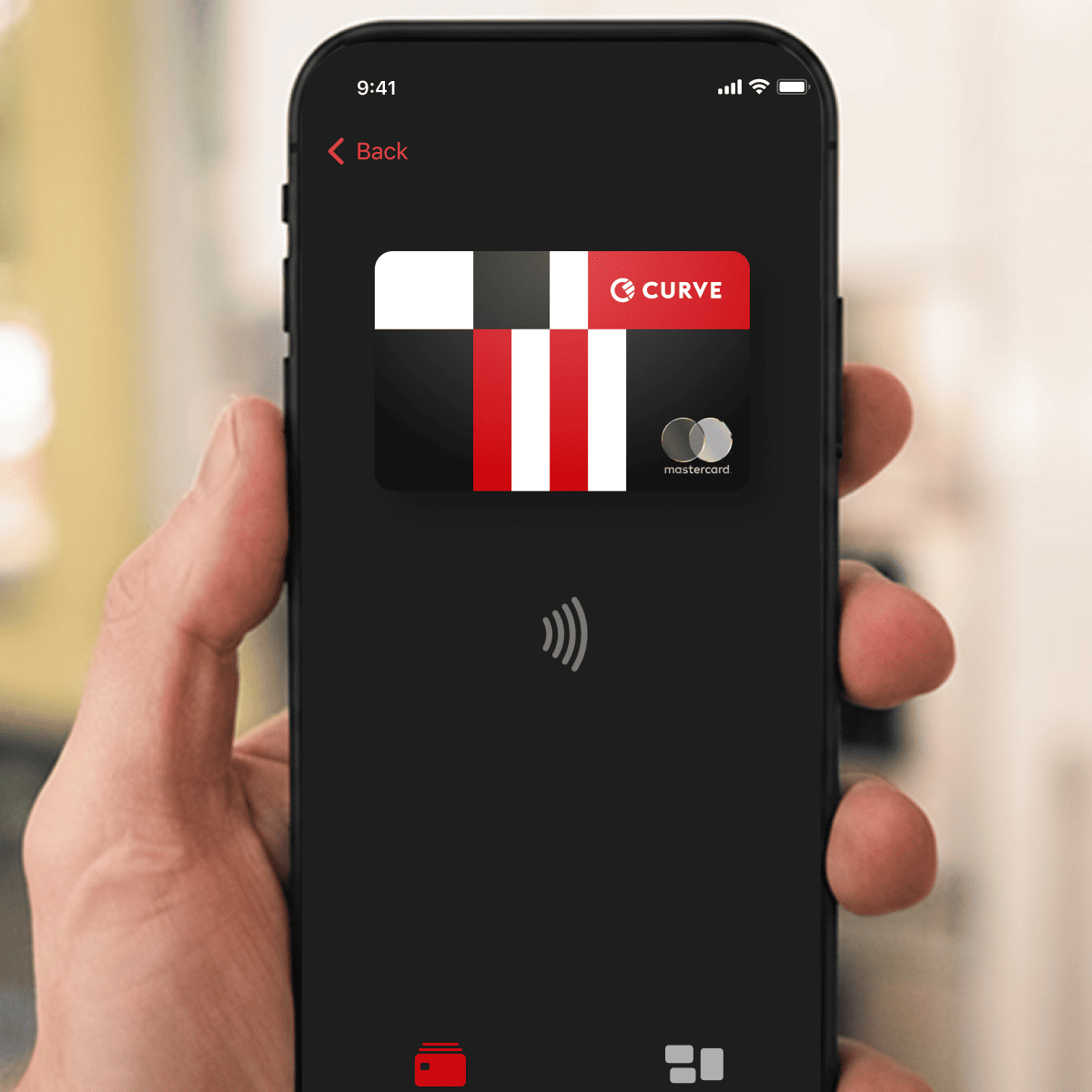

Set Curve Pay for contactless payments in-store and link Curve Pay to Apple and Google Pay for ease of online transactions. Even get a physical Curve Pay card for cash withdrawals or a wearable device to leave your phone at home!

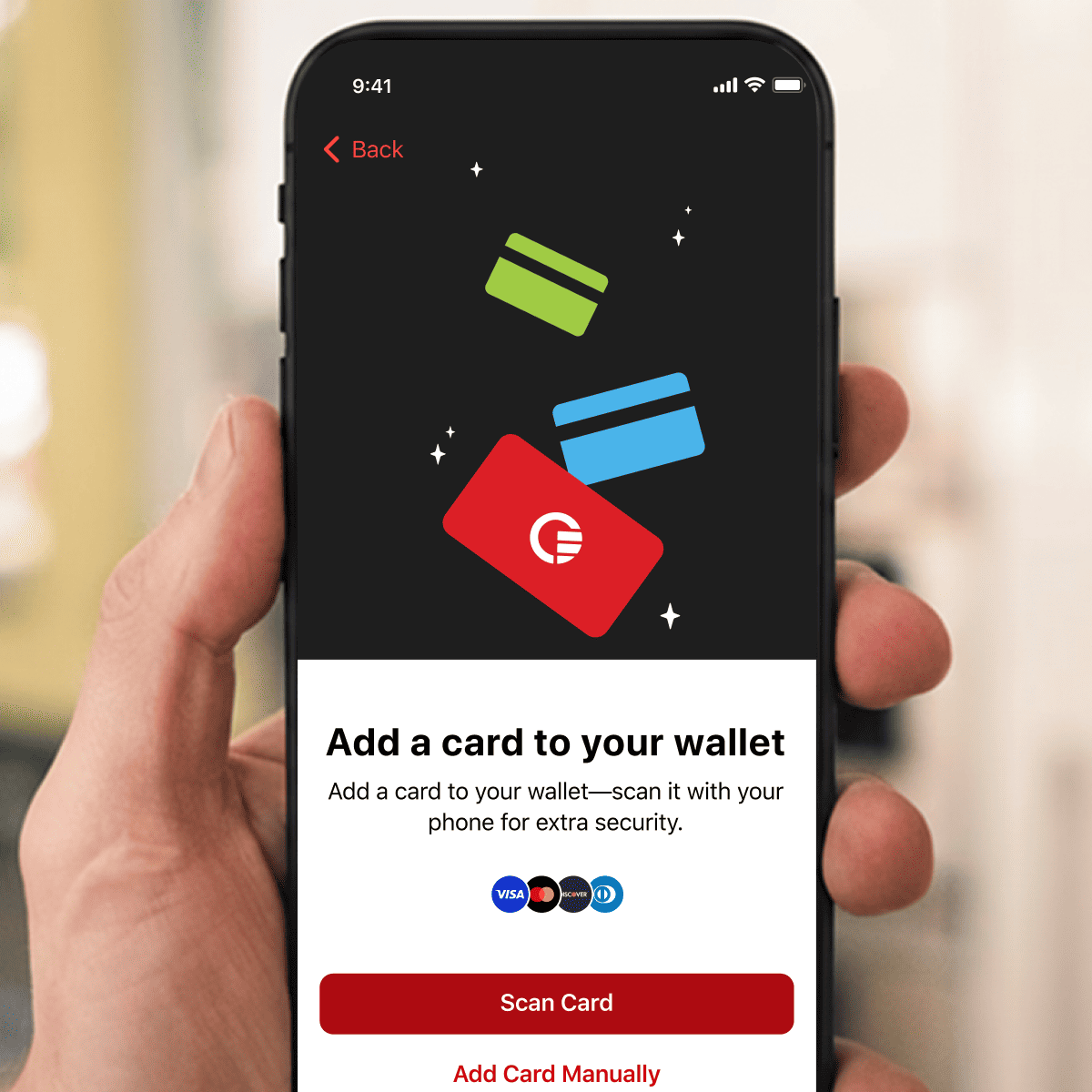

Add your debit and credit cards to your Curve Pay digital wallet. You can start with just one, but you'll benefit from Smart Rules, Anti-Embarrassment and Go Back in Time® when you add more. Select the card you want to use for your payments and you're ready to go!

Spend and earn cashback, save on foreign currency exchange fees, gain money freedom.

1% cashback for Curve Pay Pro subscribers at 6 selected retailers (up to £25 per month) and Curve Pay Pro+ subscribers at 12 selected retailers (up to £50 per month), for the subscription period (please refer to our Fair Use Policy for more details).

For UK customers, FSCS protection does not apply to the funds held on your Curve Cash Card and your funds may be at risk in exceptional circumstances.